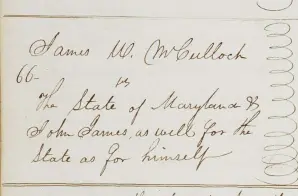

This document shows the Supreme Court’s decree in McCulloch v. Maryland. It comes from a volume of Supreme Court minutes describing the proceedings of the Court.

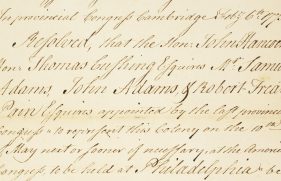

In this landmark Supreme Court case, Chief Justice John Marshall handed down one of his most important decisions regarding the expansion of Federal power. This case involved the power of Congress to charter a bank, which sparked the even broader issue of the division of powers between state and the Federal Government.

In 1816, Congress established the Second National Bank to help control the amount of unregulated currency issued by state banks. Many states questioned the constitutionality of the national bank, and Maryland set a precedent by requiring taxes on all banks not chartered by the state — in 1818, the State of Maryland approved legislation to impose taxes on the Second National Bank chartered by Congress.

James W. McCulloch, a Federal cashier at the Baltimore branch of the U.S. bank, refused to pay the taxes imposed by the state. Maryland filed suit against McCulloch in an effort to collect the taxes. The Supreme Court, however, decided that the chartering of a bank was an implied power of the Constitution, under the “elastic clause,” which granted Congress the authority to “make all laws which shall be necessary and proper for carrying into execution” the work of the Federal Government.

This case presented a major issue that challenged the Constitution: Does the Federal Government hold sovereign power over states? The proceedings posed two questions: Does the Constitution give Congress power to create a bank? And could individual states ban or tax the bank?

The court decided that the Federal Government had the right and power to set up a Federal bank and that states did not have the power to tax the Federal Government. Marshall ruled in favor of the Federal Government and concluded, “the power to tax involves the power to destroy.”